Increase efficiencies and productivity by automating core reporting tasks for medical writing.

Automate core regulatory report documents across the CTD pyramid and dramatically accelerate submission timelines.

Increase efficiencies and productivity by automating core reporting tasks for medical writing.

Automate core regulatory report documents across the CTD pyramid and dramatically accelerate submission timelines.

Today, finance departments dedicate significant time and resources to data interpretation. With Yseop, transform your quantitative data sets into high quality written analysis – all securely, at scale, and in an easily digestible format. With AI-powered technology, unburden your teams and streamline your finance and risk reporting processes.

Implement pre-packaged tools to augment your core financial reporting needs. By automating this process, teams can focus on valuable strategic work and better support decision-making across the business.

Discover how Yseop’s no-code Yseop Copilot supports the controller and eliminates time-consuming report writing.

From identifying potential risk, making sense of large and complex data sets, and automating client risk reports, Yseop’s pre-packaged solutions can assist all without writing a single line of code.

With pre-configured solutions, automate core compliance reports so your team can focus on interpretation and decision-making rather than investing valuable time in report writing. Discover how our no-code Yseop Copilot and automation pack functionality supports the controller.

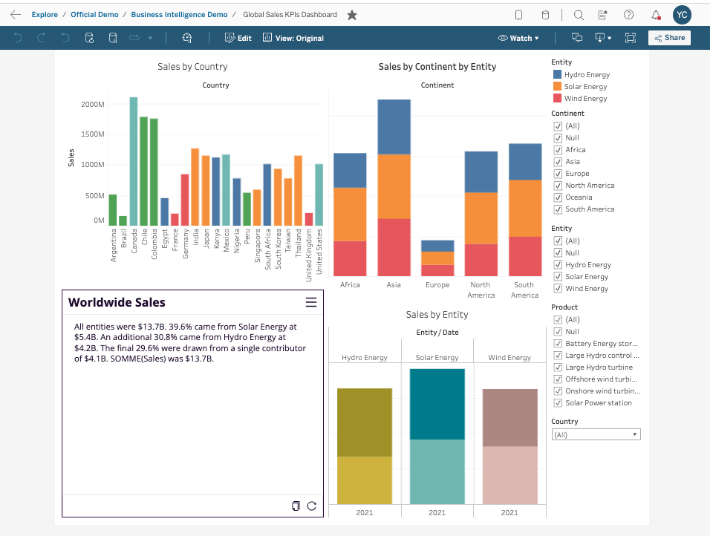

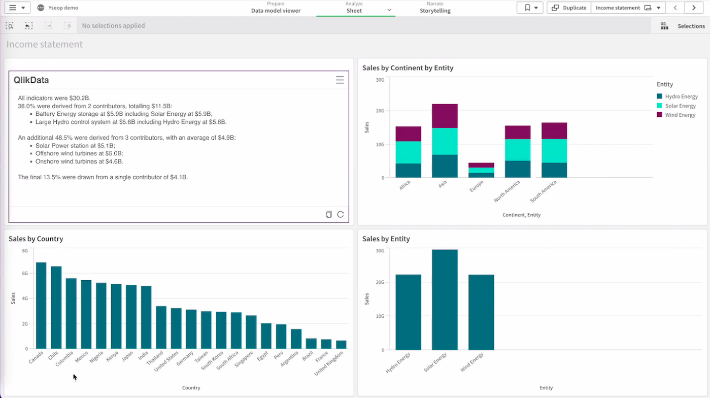

Yseop Copilot brings report automation and deeper insights to data visualization tools. Yseop’s suite of enterprise-grade plug-ins automates report writing with natural language generation (NLG) and instantly connects to BI tools like Tableau, Qlik, and Power BI all without leaving your native interface.

At the forefront of innovations and developments in AI and NLG.

Get to know the visionaries driving Yseop forward.

Join Yseop at key industry events and discover our innovative Yseop Copilot solutions in person.

Dive into innovation with AI Uncovered featuring Tim Martin.

Discover the power of Yseop Copilot platform.

Get to know the visionaries driving Yseop forward.

Join Yseop at key industry events and discover our innovative Yseop Copilot solutions in person.

Dive into innovation with AI Uncovered featuring Tim Martin.

Discover the power of Yseop Copilot platform.

Get to know the visionaries driving Yseop forward.

Join Yseop at key industry events and discover our innovative Yseop Copilot solutions in person.

Dive into innovation with AI Uncovered featuring Tim Martin.

Discover the power of Yseop Copilot platform.

Finance & Risk: Automation for Finance & Risk

ChatGPT is a general-purpose assistant designed for open dialogue. Yseop Copilot is a structured platform built specifically for regulated content automation in life sciences, with full traceability and compliance by design.

Agents automate complex, repeatable processes with consistency and compliance. They support scalable document generation while reducing manual effort and maintaining auditability.

Yes. Yseop Copilot is actively used by leading pharmaceutical companies to generate validated, compliant documents across a range of regulated content workflows.

Yes. Yseop uses a deterministic form of RAG. All retrieval logic is defined during system setup to ensure that outputs are based only on validated, traceable content sources.

LLMs are flexible but probabilistic, while Symbolic AI is deterministic and traceable. By combining both, Yseop achieves a balance of creativity, precision, and control that is critical for regulated document generation.

Agents are the building blocks of Yseop Copilot. Static agents follow predefined workflows. Dynamic agents adapt in real time, selecting tools, executing actions, and validating results.

Yseop uses a Composite AI strategy that combines Symbolic AI and large language models (LLMs), supported by innovations like GraphRAG and SLM to ensure traceability, compliance, and scalability.

LLMs are not assistants but they’re specialized components in our AI system. We use them to power structured generation within controlled workflows, as part of a composite AI strategy that combines flexibility with precision. This balance ensures that generative AI becomes usable, trustworthy and scalable for regulated industries.

Yseop selects LLMs based on each specific use case. Every model is rigorously evaluated to ensure accuracy, traceability, and compliance with life sciences standards before deployment.

Yseop has progressed from static automation to dynamic, agentic intelligence. Future agents will self-configure, generate and validate code, and optimize workflows. This approach enables scalable automation across medical writing, regulatory operations, and beyond.

Generative AI is a class of AI techniques that involve creating content, data, or output that is not directly copied from existing examples, but rather generated by the AI system itself from data and documents.

Yseop uses generative AI for content creation in regulated industries like life science and finance. We use several types of generative AI technologies and techniques depending on the type of information used as an input and the target output format (e.g. table, text, etc.)

ChatGPT is general-purpose and unpredictable. Yseop Copilot is purpose-built for life sciences: structured, auditable and compliant automation for regulated document generation.

Yseop minimizes hallucination risk by using domain-specific models, structured and validated data inputs, and a rigorous evaluation framework. Each use case is tested before deployment and monitored through built-in quality controls.

Yseop is not currently integrated with Microsoft Copilot. Future integration may be considered if features meet the platform’s standards for security, traceability, and compliance.

Open prompts introduce variability and reduce control. Yseop uses configured intents and structured workflows to ensure consistent, repeatable, and validated outputs aligned with regulatory requirements.

No. Yseop Copilot is meant to act as a tool to empower users to be more innovative and analytical, while automating structured, repetitive processes and calculations.

Yseop Copilot offers a platform that can automate different documents. Those documents are handled by a specific automation pack. Automation packs consist of packaged components and configurations specific to a use case or document. This affords you the freedom to select the precise automation pack that aligns perfectly with your unique requirements, granting you a solution that’s as adaptable as it is efficient.

Currently, we offer automation packs for a variety of use cases including clinical study reports, clinical trial narratives, corporate finance, credit risk, and much more.

Yes! If you are interested in learning more about Yseop’s content automation solutions, we encourage you to sign up for a free trial to see the technology work in action.

Clinical study reports, clinical trial narratives, summary clinical safety, and preclinical study reports for pharmacokinetics.

Let’s start automating your data to narratives today!